Exploring IPC Section 472: The Creation of Forged Seals and Instruments for Forgery. IPC Section 472 criminalizes the act of making or possessing instruments or materials specifically designed to create forged seals, documents, or instruments, with the intent of using them for forgery. This section aims to curtail the tools that enable fraudulent activities by targeting not only the act of forgery itself but also the preparations made for committing forgery. This article delves into the intricacies of IPC Section 472, covering its key elements, penalties, real-world case studies, and its significance in safeguarding the integrity of official and legal documents.

Exploring IPC Section 472 The Creation of Forged Seals and Instruments for Forgery

Introduction to IPC Section 472

Forgery, as a criminal offense, involves more than just falsifying documents or signatures; it also includes the creation or possession of tools that facilitate the forgery process. IPC Section 472 addresses this aspect of forgery by criminalizing the making, possession, or intent to use instruments specifically designed for forging documents and seals. These instruments could range from stamps and seals used by government offices to other materials like engraved plates for forging financial documents.

According to IPC Section 472: “Whoever makes or counterfeits any seal, plate, or other instrument for the purpose of committing any forgery which would be punishable under any section of this Chapter, or, with such intent, has in his possession any such seal, plate, or other instrument, shall be punished with imprisonment for life, or with imprisonment of either description for a term which may extend to seven years, and shall also be liable to fine.”

This provision underscores that the law treats not only the act of forgery itself but also the preparation for forgery as a serious crime. The focus is on preventing individuals from having the means to forge official documents, seals, or instruments.

Key Elements of IPC Section 472

To establish guilt under IPC Section 472, certain key elements must be proven in court:

- Creation or Counterfeiting of Instruments: The accused must have either made or counterfeited any instrument, such as seals, plates, or other tools, for the purpose of committing forgery. These instruments are specifically designed to create forged documents, official stamps, or legal materials.

- Possession of Forgery Tools: The accused may also be charged if they possess such instruments with the intent to use them for forgery. Even if the tools have not been used yet, mere possession with the requisite intent is sufficient for prosecution.

- Intention to Commit Forgery: The intent to use these instruments for committing forgery must be established. The prosecution must prove that the instruments were intended to be used for forging documents or official materials, such as property deeds, identification papers, or seals.

- Applicability to a Range of Forgery-Related Crimes: IPC Section 472 applies to instruments used for committing forgery punishable under other sections of the IPC, such as sections 463 (general forgery), 467 (forgery of valuable security or wills), 468 (forgery for cheating), and others.

Types of Instruments Covered Under IPC Section 472

The instruments covered under IPC Section 472 are those specifically designed for the purpose of forgery. These include, but are not limited to:

- Seals: Counterfeit seals that resemble those used by government departments, public offices, or legal institutions for authenticating documents.

- Plates and Engraving Tools: Tools or plates used to create forged signatures, official stamps, or logos, often used in legal documents or financial instruments.

- Printing Machinery: Machines or tools used to replicate official documents such as banknotes, certificates, or identification cards.

- Other Instruments for Forgery: Any tool that aids in creating false documents, whether it be for identification fraud, financial fraud, or property-related forgery, falls under the scope of this section.

Punishment for Offenses Under IPC Section 472

The punishment under IPC Section 472 is severe due to the gravity of the offense. If found guilty, the offender may face:

- Imprisonment for Life: In cases where the forgery involves highly sensitive instruments, such as government seals, official documents, or security instruments, the accused may be sentenced to life imprisonment.

- Imprisonment for a Term of Seven Years: If the forgery is of a lesser nature but still involves the creation or possession of instruments for forgery, the punishment may extend up to seven years.

- Fine: In addition to imprisonment, the court may impose a fine depending on the severity of the forgery or potential financial damage caused by the use of such instruments.

Significance of IPC Section 472 in Safeguarding Authenticity

In today’s world, where documents and official seals play a crucial role in governance, commerce, and personal identification, IPC Section 472 is vital in preserving the integrity of such materials. Here’s why this section holds great significance:

- Preventing Organized Forgery Operations: Counterfeiting seals, stamps, and instruments often involves organized criminal activities aimed at defrauding individuals or the state. Section 472 provides a legal framework to punish not only the perpetrators but also those who facilitate such crimes by creating or possessing the necessary tools.

- Safeguarding Official Documents: Seals and stamps are often used to authenticate government orders, legal documents, educational certificates, and financial instruments. IPC Section 472 ensures that individuals who attempt to undermine the authenticity of such documents by creating counterfeit seals are held accountable.

- Combating Identity and Financial Fraud: Many cases of identity theft and financial fraud are based on forged documents that require the use of counterfeit seals or instruments. This section helps prevent fraud at the preparatory stage by punishing individuals who possess the tools for such forgery.

Case Studies Illustrating IPC Section 472

Case Study 1: Counterfeit Government Seals for Land Transfer Fraud

In State v. Ajay Kumar Sharma, the accused was found guilty of creating a counterfeit seal that resembled the official seal of a government land registry office. The forged seal was used to create fake property transfer documents, which were then used to claim ownership of a disputed piece of land. The forgery was discovered when the original landowners filed a legal case challenging the authenticity of the documents.

The court convicted the accused under IPC Section 472, as he was found to have created the counterfeit seal with the intent to commit forgery. He was sentenced to life imprisonment due to the severe impact the forgery had on legal land ownership records. The court emphasized that such forgery undermines the trust and integrity of property transactions in the country.

This case highlights the serious nature of forgery related to government seals and property documents, and the importance of Section 472 in maintaining the authenticity of such transactions.

Case Study 2: Forged University Seal for Fake Degrees

In Ravi Kumar v. State of Madhya Pradesh, the accused was involved in creating fake university degrees by counterfeiting the official seal of a reputed university. These fake degrees were sold to individuals seeking employment in various sectors, including government jobs. The scam was uncovered when one of the buyers of the fake degrees was caught during a background check.

The court charged the accused under IPC Sections 465 (forgery) and 472 for creating the counterfeit seal with the intent to commit forgery. The accused was sentenced to ten years of imprisonment and fined. The court noted that using counterfeit instruments to create fake educational documents not only defrauds individuals but also harms the credibility of educational institutions.

This case demonstrates how IPC Section 472 applies in cases where forged instruments are used to undermine the integrity of educational qualifications and professional certifications.

Case Study 3: Counterfeit Bank Stamps for Financial Fraud

In State v. Abdul Rehman, the accused created counterfeit bank stamps, which were then used to forge official bank documents, including loan approval papers and fixed deposit certificates. The forged documents were used to deceive financial institutions into releasing large sums of money. The forgery was discovered when one of the bank’s internal auditors noticed discrepancies in the loan documents.

The court found the accused guilty under IPC Section 472 for creating the counterfeit bank stamps with the intent to commit forgery. He was sentenced to seven years of imprisonment and fined a substantial amount to cover the financial loss caused by the fraud. The judgment emphasized the need to protect financial institutions from forgery-related fraud.

This case highlights the role of Section 472 in preventing financial fraud by targeting the tools used for such activities.

Defenses Against Charges Under IPC Section 472

Despite the seriousness of the offense, individuals charged under IPC Section 472 may raise certain defenses in court:

- Lack of Intent: The accused may argue that they did not have the intent to use the instruments for forgery. The prosecution must prove that the possession or creation of the instruments was with the intent to commit forgery.

- No Knowledge of Forgery: The accused may claim that they were unaware that the instruments in their possession were designed for forgery. If they can prove that they did not know about the nature or purpose of the tools, they may not be convicted under Section 472.

- False Implication: The accused may argue that they were falsely implicated in the crime and that the counterfeit instruments were planted or belonged to someone else.

Conclusion

IPC Section 472 serves as a crucial provision in preventing forgery by addressing the tools and instruments used to commit such crimes. By targeting the preparatory stages of forgery, this section helps curtail fraud before it can cause significant harm to individuals, institutions, or the state. Whether it involves counterfeit seals used for property fraud or fake stamps for financial deception, Section 472 ensures that individuals involved in the creation or possession of forgery tools face serious legal consequences.

📚 Explore More Legal Services at VantaLegal

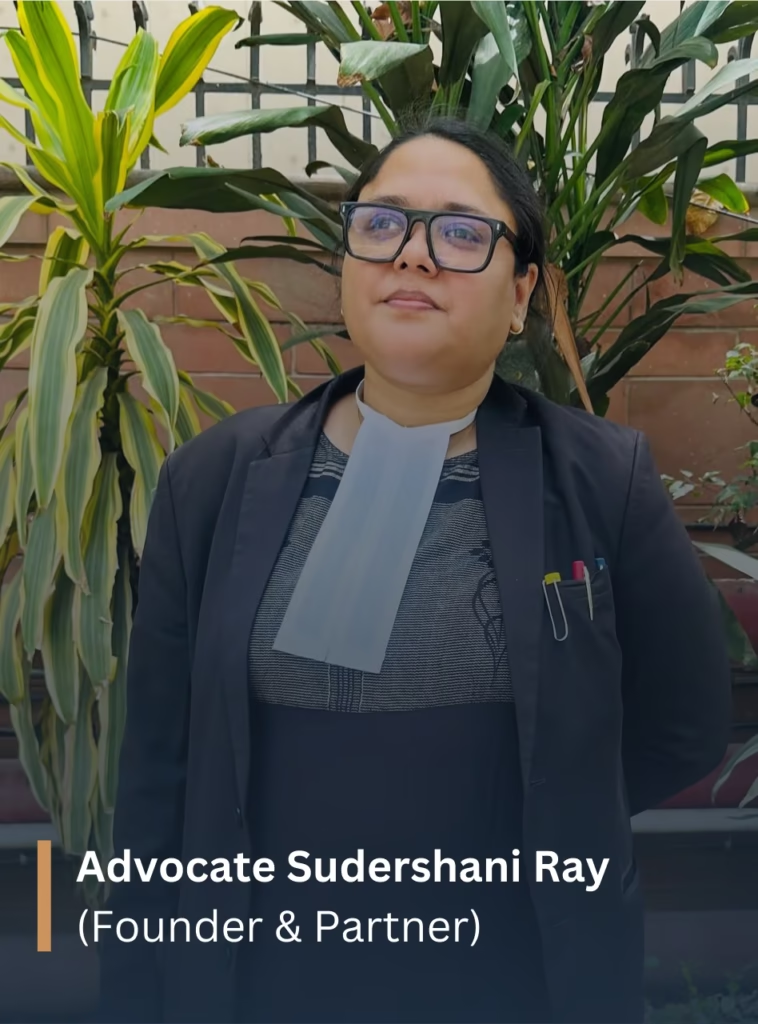

📞 Contact Vanta Legal | Advocate Sudarshani Ray

Have a legal question or need expert advice? Get in touch today.

📧 Email: vantalegalofficial@gmail.com

🔗 Contact Page: https://www.vantalegal.com/contact-us/