Table of Contents

ToggleNavigating Property Transactions: Essential Insights for Buyers and Sellers. Property transactions are a critical aspect of real estate. Whether you are buying a home or selling a commercial space, understanding the process is vital. This article will break down important elements related to property transactions. It will focus on practical insights and legal considerations that both buyers and sellers should keep in mind.

Navigating Property Transactions Essential Insights for Buyers and Sellers

The Basics of Property Transactions

Property transactions involve the transfer of ownership from one party to another. This process can be complex, requiring careful planning and legal knowledge. Here’s what you need to know.

Key Players in Property Transactions

- Buyers: Individuals or entities looking to acquire property.

- Sellers: Those who own property and wish to sell it.

- Real Estate Agents: Professionals who facilitate the buying and selling process.

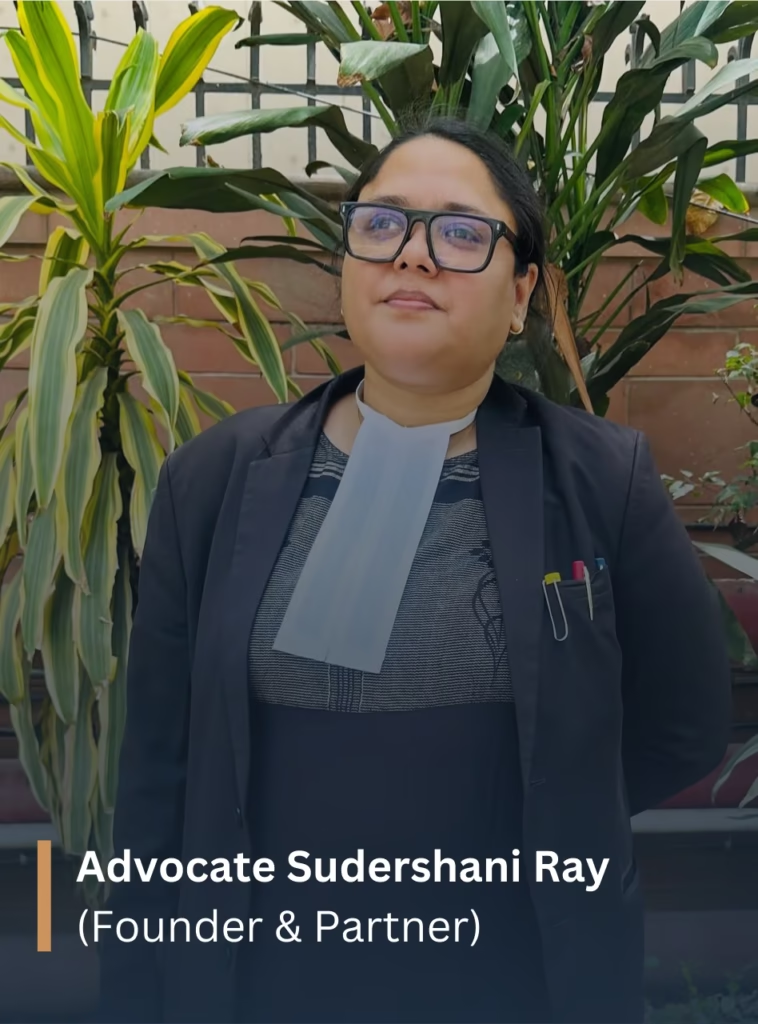

- Lawyers: Legal experts who ensure the transaction complies with laws.

Types of Property

- Residential Property: Homes, apartments, and condominiums.

- Commercial Property: Offices, retail spaces, and warehouses.

- Industrial Property: Factories and manufacturing sites.

- Vacant Land: Undeveloped land for potential future use.

Understanding the Property Market

Before entering a transaction, it’s essential to understand the market. Knowledge of current trends can help you make informed decisions.

Market Trends

Supply and Demand: Affects property prices. High demand and low supply typically drive prices up.

- Interest Rates: Lower rates can make borrowing cheaper, increasing buyer activity.

- Economic Indicators: Unemployment rates and GDP growth can influence buyer confidence.

Preparing for a Property Transaction

Preparation is key for a successful transaction. Both buyers and sellers should take specific steps.

For Buyers

Determine Your Budget: Know how much you can afford. Factor in down payment, closing costs, and ongoing expenses.

- Get Pre-Approved for a Mortgage: This shows sellers you are serious and capable of buying.

- Research Locations: Consider neighborhoods that fit your lifestyle. Look at schools, amenities, and safety.

- Engage a Real Estate Agent: An experienced agent can provide valuable insights and help you find the right property.

For Sellers

- Set a Competitive Price: Research similar properties to determine a fair price.

- Improve Curb Appeal: First impressions matter. Simple fixes can enhance your property’s appeal.

- Disclose Issues: Be honest about any problems with the property. This builds trust with potential buyers.

- Choose the Right Time to Sell: Timing can influence your sales. Spring and summer are often popular times to sell.

The Legal Framework of Property Transactions

Understanding the legal aspects of property transactions is crucial. This ensures compliance and protects your interests.

Purchase Agreement

A purchase agreement is a legal document that outlines the terms of the sale. Key components include:

- Property Description: A clear description of the property being sold.

- Purchase Price: The agreed-upon amount for the property.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspections.

- Closing Date: The date when the transaction will be finalized.

Title Search

A title search verifies the seller’s ownership of the property. It reveals any liens, easements, or other claims against the property. This step is essential to ensure a clear title.

Closing Process

Closing is the final step in a property transaction. It involves signing documents and transferring funds. Here’s what to expect:

- Final Walk-Through: Buyers should inspect the property one last time to ensure it meets their expectations.

- Review Closing Documents: All parties will review and sign necessary documents.

- Transfer of Funds: Buyers will transfer the purchase price, and sellers will receive payment.

- Recording the Deed: The new deed is recorded with the local government, finalizing the transfer of ownership.

Common Issues in Property Transactions

Even with careful preparation, issues can arise during property transactions. Being aware of common problems can help you navigate challenges.

Financing Issues

Buyers may face challenges securing financing. Changes in employment or credit can impact mortgage approval. Always keep lenders informed of your financial situation.

Inspection Contingencies

Home inspections may uncover hidden issues. Buyers should be prepared to negotiate repairs or credits based on inspection findings.

Title Problems

Title issues can delay or derail a transaction. If a title search reveals liens or disputes, these must be resolved before closing.

Appraisal Concerns

Lenders require appraisals to ensure the property’s value aligns with the purchase price. If the appraisal comes in lower than expected, it may lead to renegotiation.’

Also Read This,

Understanding White Collar Crime An Overview

Conclusion: Navigating Property Transactions Successfully

Property transactions can be complex, but with the right knowledge and preparation, buyers and sellers can navigate the process smoothly. Understanding market trends, engaging professionals, and being aware of legal requirements are essential steps.

By staying informed and proactive, you can ensure a successful transaction that meets your needs. Whether buying or selling, knowledge is your best ally in the world of property.